Your successful digital transformation must be driven by a compelling Why. In this article, we drill into the creation of a Great Stock, looking at Total Shareholder Return as the guiding metric. (Part of a series of articles about Enterprise Value Creation for Digital Business.)

My company is excited at the prospects of a digital transformation!

Excited?

Well, maybe concerned. Confused. Unsure of how to proceed.

A typical response, as digital transformation has already become an overused buzzword. Still, many organizations can see the potential and the promise of a truly transformational change, one that contemplates operations, customers, products, and employees – critical components of a great digital business.

Plenty of promise for a bright digital future – but these transformations are competing with other strategic initiatives. The key to getting started is to come up with a compelling answer to a simple question – Why?

For some organizations, this is simple – changing market conditions (competition, customer demand, the economy) can force their hand, and “going digital” becomes a survival requirement. Other companies will pivot based on the vision and strategy of their leadership team – well-defined or not, they will go where the boss points.

But for many organizations, it is challenging to introduce suggestions and new ideas to the project list. How do you effectively get the attention – and the commitment – of the folks on the shop floor, the people connecting with your customers, and the leadership team running the show?

A common element of business is the idea of Value Creation. Many folks will over-summarize their primary objectives; we built this company to solve problems, provide great jobs, and make a fair profit. Simple stuff – and very useful. But when building a business case for big changes and large projects, it helps to have compelling examples and metrics. When searching for these specifics, we can look at three different definitions of Value Creation to get specific targets for measurable impact.

Classic ‘Business Benefits’ are Financial

The first area to look at has long been the most common. For significant change projects, the business world still prefers measurements that match up to the traditional financial metrics – increase revenue, lower cost, and increase cash flow.

Simple, right? Come up with a project justification that demonstrates how you will make more money, lower overall costs, and lower your inventories, and things will move very fast. But what about those investments that involve system upgrades, government compliance, or cybersecurity? Sure, there might be a threat of lost sales, but preventing loss is different than creating growth. There seems to be an element of chance here.

For smaller initiatives, that can be a tough hurdle in the competition for attention. But we are talking about significant changes here – the transformation of the company to a new digital reality. Discussion about sweeping change, strategic drivers, and cultural impact are the kind of things that go to the Leadership Team and the Board. And those groups do not typically talk about increasing sales and cutting costs.

Value for the Shareholders

Well … not that specifically. There is a context for such details – the overarching goal of the company, to create value for the shareholders. Also known as Total Shareholder Return, this is the raw, capitalist form of value creation. For public and private companies, we are talking about the overall enterprise value and the growth in value over time. Publicly traded companies calculate this daily using the stock price; for private companies, it is quantified when the company changes owners – the market sets the price.

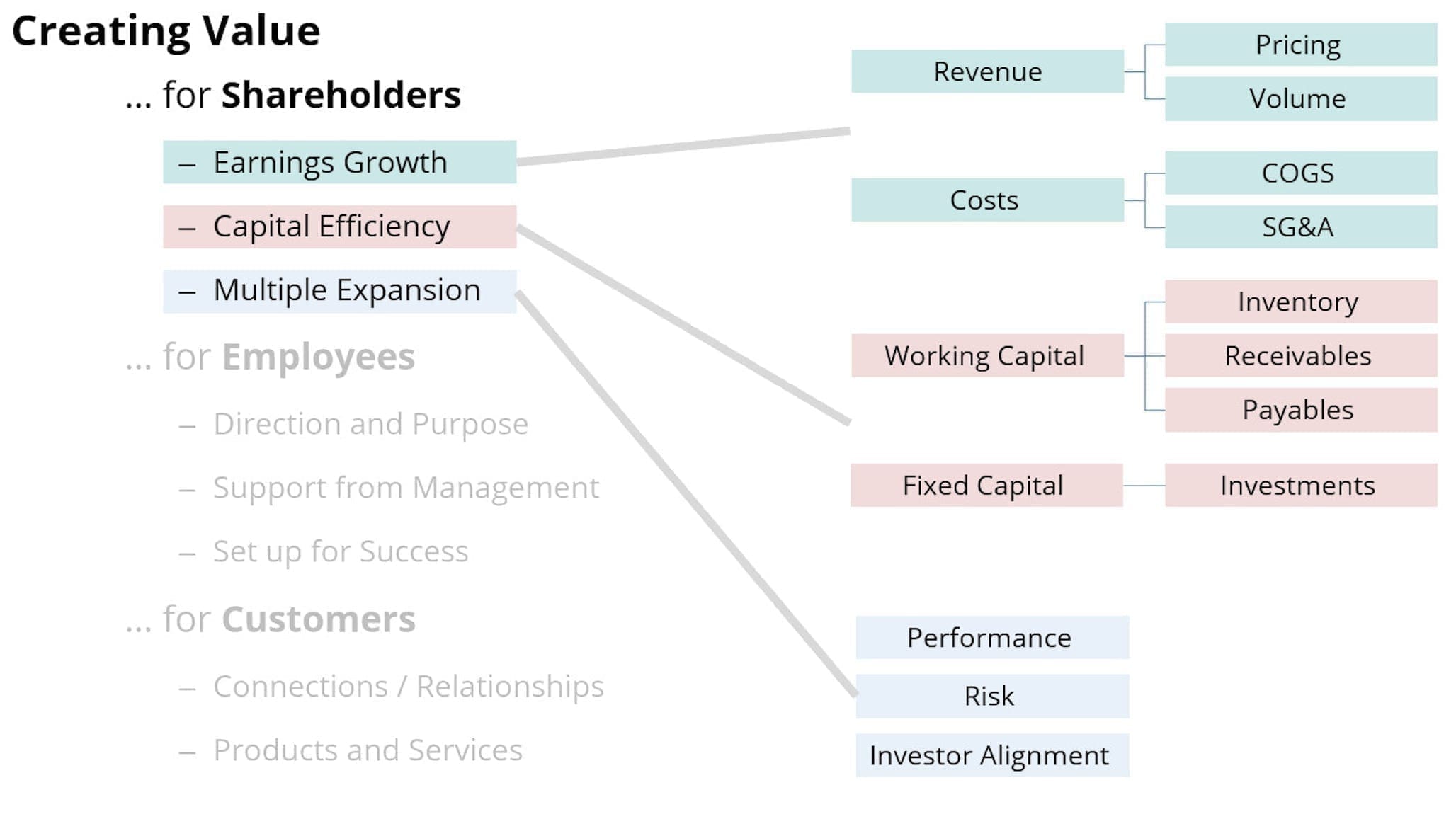

Regardless of the timing, the value of a company is driven by three fundamental levers, three simple conversations …

- Earnings Growth: How much cash do you take in, and what do you spend to make that happen?

- Capital Efficiency: How do you leverage the money you have been given?

- Multiple Expansion: How badly does someone want to buy this company?

That last one is the most interesting; after all the fancy financial calculations, it’s like a rare comic book on the auction block – who will bid up the price? And why are they doing that?

Of course, this is still a bit high concept and hard to relate to. When we drill down to the next level, we find common, easy-to-understand components of each of these values. These are specific levers that we know how to pull – they are the stuff of most business case justifications.

Earnings Growth comes from …

- Increased Revenue through Volume Increases (sell more) and Price Optimization (charge more)

- Decreased Costs targeting Cost of Goods and Overhead

Working Capital improvements come from …

- Inventory Reduction in the warehouse – ready-to-ship goods, as well as raw materials and work-in-process

- Managing Receivables (get people to pay faster) and Payables (while you pay your vendors more slowly)

Breaking things down like this gives us all manner of “hooks” to connect to our transformational initiatives. Well-run companies talk every day about critical metrics and key performance indicators that drive these bullet points. And your digital projects can and should tie to those same KPIs if they hope to gain traction.

A quick note – there are other contributors to Capital Efficiency, including investments, tax, cash management, and other complicated and sophisticated financial work that gets done. I am not adding those activities to this discussion – partly because a digital transformation impacts them less, and partially because … well, it’s gosh-darned sophisticated and I am sticking to what I know …

What about Multiple Expansion?

This is the area that seems to be the most mysterious and difficult to quantify – because it is. It’s all about how the investors, the street, or the buyers feel about the strength of the firm, and the organization’s ability to generate Earnings Growth, Capital Efficiency, and Cash Flow in future years.

Multiple Expansion improvements come from …

- Performance: Does the company hit it’s projections for profits and cash every time?

- Risk: Does the organization plan for the future, and pay attention to potential disruptions?

- Investor Alignment: How does the street feel about the company?

A quick note – Yup, that last one sounds squishy. There is always an element of “what the market will bear” in any transaction – how else do you explain market bubbles and crazy multiples?

Digital Value: Tying Shareholders to your Digital Transformation

Our goal is not to account for every component of Total Shareholder Return – we do not need to. There are plenty of compelling and measurable improvements that we can align with our transformation roadmaps and initiatives. Call them Digital Opportunities …

- Operations: Automating the shop floor to slash the cost of poor quality and decrease waste (reduce cost)

- Customers: Implementing eCommerce tools to service lower profitability products (reduce cost)

- Products: Developing data-rich monitoring services as new products (increase revenue)

- Data: Leverage statistical methods and AI to improve supply chain planning forecasts (reduce inventory)

- Team: Implement collaborative workspaces to capture better data about customers and simplify the AR managers’ collection processes (accelerate cash)

Even cybersecurity projects can connect to the idea of creating digital value for shareholders – by materially reducing the amount of risk in the business. Many public companies are already seeing cyber issues popping up in their annual cycles.

Like anything, the specifics can get really heavy really quick. But at the right level, the picture becomes simple. With a clear understanding of the specific value levers that your digital initiatives will deliver, you can prioritize investment and resources correctly. This basic framework can help us answer our first important question: How are we building a more valuable company, and driving market value, by adding digital capabilities?

Up Next: Value for the Employees

6 May, 2020

Comments (0)