A review of specific examples where Smart, Connected Products (IoT) can generate organic revenue growth.

When talking with a Business Unit about contributing to earnings with “Information as a Product or Service”, the fun part of the conversation is getting into the specifics. Where exactly are we going to make money here – and how much? What is the Size of the Prize?

Well, maybe more fun for me than for the Product Line manager – this is the exciting part of their job, where they make commitments on Revenue and Return. I know that throughout the organization, the entire Product Line team (engineering, operations, marketing, sales) feel the same level of commitment. And I like to point out that this [typically] is just the beginning of the conversation – the dance between initiating the Cost (by starting a build project) and delivering the Benefit (by recording sales).

Still, the whole Internet of Things (IoT) thing is a new way of thinking for most industrial manufacturers – the great leap from “making and shipping Stuff” to “providing and supporting Data-Enabled Stuff”. This leap introduces major changes in how products and services are created and supplied to our customers; is there also a huge change in the way we monetize those products and services?

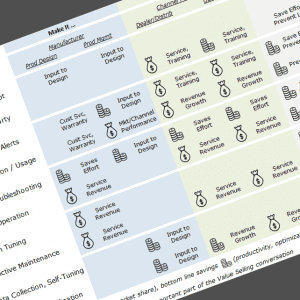

Yes and no – most of the revenue models are familiar to manufacturers that provide aftermarket parts and service to their customers, or introduce product line extensions into existing markets and near adjacencies. Some of these revenue models include …

- New Product: IoT devices and software are new products, new SKUs to be added to the customer invoice. This might mean completely new finished goods, or modules / options that can be added on to an existing product. To figure out the return, Marketing will need to determine a unit price and estimate incremental sales in units.

- Next Generation: An alternative scenario for the add-ons – instead of offering as an option, make the data-enabled capability a new standard feature. This would address the challenges of SKU proliferation and complexity, and reduce the problem of cannibalizing sales from other SKUs.

- Retrofit: Will Engineering be able to design something that can be added on as an in-field upgrade to the installed base? Depending on technical complexity, this may be an important challenge for the product engineers to solve for – and an arguably easier source of revenue, since we’re strengthening our relationship with established customers.

Note that the ideas to this point are all one-time revenue, very much in line with the way manufacturers see ourselves; we make and sell Things. But what about the idea of Information as a Service? Like aftermarket parts and maintenance / service contracts, this IoT revenue comes in less discreetly (x units, y price, z delivery date) and more continuously (x units / users, y cost per month). Unit price decreases, but the volume increases – with all of the benefits of recurring revenue (less bumpy, more predictable, better forecast).

- Service Subscription: Data, reports, analytics, and proactive product maintenance can all be delivered as part of a monthly fee-for-service model.

- Analytics Services: What if the data is very specific to your particular piece of equipment – should end-users or the distribution channel be expected to understand the domain as completely as your engineers? What if you made your product experts available to look at the customers’ data details and provide consulting and guidance on the best way to use the equipment?

Other Impacts

A Bigger Pie (and Slice Thereof): How will adding data to your product offering change the market? When developing the Marketing Plan and justifying the Cost / Benefit model, it will be important to understand what you are proposing to do to the market. Will you simply take share from the competition with your superior product offering, now bundled with differentiating services? Or will you increase the size of the addressable market by adding new products, new services, or by entering new geographies and/or verticals?

Incremental Innovation: You might be tempted to look at information-enabling a Product Line as simply the Next Generation of product development – this year’s latest feature. This is a conservative approach, and overlooks the potential for changing the game in your industry. It’s a valid move – but a bit too conservative for me, and not something I am recommending to folks.

A Bigger Data Eco-System: Some vertical markets already have major OEM players developing data-enabled “environments” that you may need to play in. In Agriculture, for example, you can see the moves that equipment manufacturers like Case International and John Deere are making to information-enable the farmers. Are they the only game in town? No – other major Ag players like Monsanto are making moves in this area; you may need to pick a player, or try to hook into many alternatives, instead of striking out on your own.

Note that these revenue ideas and market impacts are not separate and distinct – information-based products and services can be introduced using a number of these ideas. We are not seeing any set patterns just yet, and are looking at other ideas as well.

29 December, 2014

Comments (0)