Each functional area in your company needs to understand the skills and strengths that they bring to a Digital Transformation effort; why do they deserve a “seat at the table”? First up is the Finance team - with their depth of experience with data and information, Finance can and should play a critical role. (part of a series)

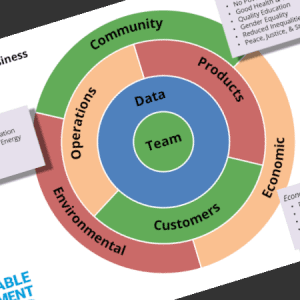

The success of your Great Digital Business will be driven by your leadership teams’ ability to come together in a new and different way. Diverse areas of expertise need to mix and merge, bringing their unique strengths to the table to create something that’s bigger than the sum of its parts.

The attraction of a Digital Transformation is the Exciting Future of technology that promises to change the action parts of our jobs (how we do what we do), as well as the thinking parts (how we get better at it). The challenge of a Digital Transformation is the entrenched power of the As-Is; the Current State that has stubbornly clung to how your organization thinks and acts, every day.

Helping your organization make that change is always the toughest part. To increase the odds of success, everyone on your team needs to leverage the power of the Current State – the skills and capabilities developed over the years – to enable, and really drive to the Exciting Future and ensure its success.

Each functional area needs to understand the skills and strengths that they bring to the effort; why do they deserve a “seat at the table”? Your organization will not be magically gifted with a well-written playbook of detailed instructions on how to make this transformation happen – the change has to come from within.

So how can you, in your specific functional area, bring transformational change to the organization? Let’s walk through the org chart and capture some thoughts.

Finance – Speaking in Facts

Data is the core asset of a Digital Business, and Finance is the functional area that has been deeply involved with data and information for the longest time. Makers make, Shipping ships, Customer Service serves customers … Marketers educate, and Sellers sell … but Finance has always been the profession of numbers, accounting for costs and revenues and tracking the value of the company and what we produce. This long pedigree of “speaking in facts” is reflected in the first wave of Digital impact – the automation of Internal Operations and the introduction of accounting systems and ERP.

Does this mean that Finance has a natural leadership role in your Great Digital Business? Probably not – your business strategy talks about what you do, where you play, and how you win. Operational details like accounting for it all are just that – required, important, but not necessarily what differentiates the organization.

Does that mean that Finance has no seat at the table, as you plan and execute your Digital Transformation? On the contrary – with their depth of experience with data and information, Finance can and should play a critical role. As you think through each of the Five Components, these are simple yet powerful ideas can inspire your Finance teams to apply the critical strengths and capabilities, and bring those strengths and capabilities to the other functional teams.

- Speaking in Facts: Core systems and processes that support the Operations of the company – I am thinking Accounting, ERP, and other planning systems – have long been an important concentration area of the Finance team. A popular buzzword in this area is Metrics, or KPIs; you can’t manage something if you can’t measure it. This is a concept that works best when subtly and deftly applied; Finance is often best positioned to understand the applicability of a metric, and the most logical way of gathering the data. Your Finance organization can make a huge impact by helping the other areas of your Digital Business speak in facts, at the right level of detail, to make impactful decisions.

- Structure for Scale and Sustainability: Many new / more recent Digital systems and processes have been introduced since the dawn of the Internet – ever more accessible technology that can quickly be deployed to impact our Customers and our relationships with them. But in a relatively short amount of time, we have seen multiple examples of hastily implemented and resourced systems that cannot scale with growth, and are unsustainable, too reliant on key individuals or value chain partners. With their depth of experience with Operational systems, Finance should be able to share techniques for managing complexity, managing master data, and creating process that can be passed on to new teams and new people as needs change.

- Identifying Value: The excitement of new technologies like sensors, data, and informatics, applied to older, more traditional physical products, is like a siren call to engineering and product development teams searching for that breakthrough idea to spur sales and market share growth. But all too often, the product teams have a difficult time understanding how to create value – and how to accurately plan for supporting and sustaining this value over time. The Finance team is usually in the best position to understand how shareholder value is created for your company – and the levels of risk and investment that the organization is comfortable with; who better to help characterize a new products’ value proposition? In addition – product teams that are comfortable making and selling widgets probably have little experience with digits – and the costs involved in building and supporting these types of services. Finance needs to help these product teams upgrade their business plan templates to account for new patterns of revenue ramps, new metrics to understand go / no go points, and new costs structures to get where they need to be.

- New Skills for Sustainable Teams: With the mass of Data from all of these silos (Operations, Customers, Products), the task of pulling out information and insights that will drive your Digital Business forward becomes more complex. When you fully understand each step in the Data Value Chain, you realize that a breadth of skills is required, ranging from Insight and Design to Science and Execution. Combined with the ever-changing list of supporting technologies – fully buzzword compliant lists that include Big Data, Machine Learning, and Cloud – the critical component here is decidedly non-technical. Finance can and should lead the way in developing teams with this breadth of skills, to leverage the information but do it in a way that scales with growth and sustained even when there is turnover on the team.

- Partnering means Collaboration: It’s something of a buzzword heard in Finance circles – the idea that we must be Partners with the different functional areas of the business. Others might use the term collaboration, but the value of this approach – and the challenges – are similar. Most folks understand the value proposition behind the words – but to truly partner and collaborate, across organizational lines and even across geographies (time and space) requires a different set of skills. Your Digital Business must learn to think and work differently – and Finance may be in the best position to teach by example, showing the rest of the company how its done.

22 December, 2018

- How Finance can Participate in your Digital Transformation

- How Sales & Marketing can Participate in your Digital Transformation

- How Operations can Participate in your Digital Transformation

- How IT can Participate in your Digital Transformation

- Finance Participation in your Great Digital Business – The Slides

- IT Participation in your Great Digital Business – The Slides

Comments (0)