Here’s an interesting phenomenon I’ve encountered before …

When analyzing a specific section of a business, people seem to naturally focus attention and conversation on the top two or three customers/products/vendors that together represent (say) 20% of the revenues/costs/contracts. Our objective is to look at the data and identify opportunities (increase revenues, cut COGS, aggregate contracts); unfortunately, processing the data for these customers/products/vendors is currently a 100% manual task.

Of course; this is why there is apparently so much “opportunity” in the first place.

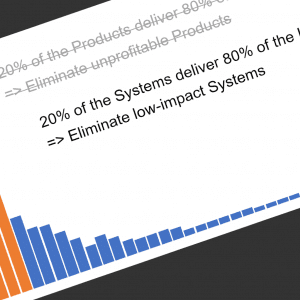

Unfortunately, it seems (at times) that folks are missing 80% of the revenue / savings opportunities out there, opportunities that are fundamentally easier to “close” on by working data that is available automatically / electronically. It’s like the Pareto / 80-20 rule in reverse, which might seem counterintuitive – going for a million singles instead of a few home runs. The mistake we’re making is focusing on the wrong 80/20.

The wrong tactic is going after the top two or three customers/products/vendors that represent the most benefit.

The correct tactic is going after the top two or three (or more!) customers/products/vendors that represent the best cost/benefit – ie. the low hanging fruit, the easy wins.

Try throwing out the “low hanging fruit” idea to break thru thinking that wants to go for the “big hits”. You’re probably going to have to rework some basic process issues (renegotiating contracts with customers / vendors, or reconfiguring production for products); might as well work the bugs out before you mess with your top customers/products/vendors.

Comments (2)

80/20 = 100%; SO, analyzing “all” the customers would INCLUDE the TOP FRUIT too, right? The idea is to make a summary of data that is all inclusive- but, efficiently/effectively identify that 20% of your customers or data that makes up 80% of the issues/problems/opportunities in the organization. What I don’t understand is that LowHanging fruit is just that: “easy pickin’s”….what happens to the top “bananas”….they grow rotten, half-eaten by competitors?! How are easy pickin’s USEFUL for identifying 80% of your market? Its an analogy I cannot logically follow to the end……….d

Think of it as a targeting exercise with a critical assumption. I do care about the 20% that fund the core of my business, yes, and I will pay them a pleasing attention. But I am looking for profitable growth, so I need to thoughtfully and purposefully target the next level, that I can grow to become part of that smaller group that contributes a ton to my bottom line.